Small business owners report challenges hiring, seeking capital

Cost of living, housing contributing to hiring challenges. Businesses owned by entrepreneurs of color are younger, smaller, and looking to grow.

Small business owners report challenges hiring, seeking capital

Cost of living, housing contributing to hiring challenges. Businesses owned by entrepreneurs of color are younger, smaller, and looking to grow.

Small business leaders across Massachusetts are looking to grow their businesses, fueling the state’s economy. But they face challenges hiring employees, gaining access to capital, and dealing with the effects of climate change on their operations. Entrepreneurs of color, whose businesses are more likely to be newer and smaller, are particularly interested in gaining access to capital to fuel their growth, but they are also more likely to report challenges doing so.

These are some of the major findings from a survey of 1,818 small business leaders, providing a comprehensive look into the state's small business landscape. This is the third wave of surveys of small business leaders in the state, with the first two occurring in 2020 and 2022. The survey was conducted by The MassINC Polling Group on behalf of the Coalition for an Equitable Economy, with sponsorship from the Mass Growth Capital Corporation and Eastern Bank Foundation. Community engagement support was provided by Harvard Catalyst.

These results will be released at an event on Tuesday, April 23 from 12-1:30PM at 255 Main Street in Cambridge. RSVP here. Another event will be held in Springfield Thursday, April 25 from 12-1:30pm. RSVP here. Links for hybrid meeting attendance will be posted before the events begin.

Small businesses looking to grow

The state economy is strong, and small businesses are looking to take advantage; 84% of business leaders consider increasing sales and revenues a “major priority”, and 77% say the same of finding new customers. To do that, businesses are also prioritizing beefing up their marketing (54%) and online presence (49%).

Black and Latino-owned businesses see even more potential and are more likely to say getting capital and hiring more workers are major priorities, alongside growth and marketing. They are also more likely to say they would like to buy or rent new space or expand existing space. Their businesses tend to be younger and smaller, as measured by numbers of employees and revenues, and so they are positioned to grow.

White and Asian-owned businesses, meanwhile, tend to be older and larger. They are also more likely to report they are planning to sell the business, or that their senior leaders are planning to retire. This so-called “Silver Tsunami” presents an opportunity for thoughtful exit planning, transitioning businesses to new owners or employee ownership.Overall, just 22% of businesses report having a succession plan in place, although that number is higher for businesses anticipating a retirement (40%) or ownership transfer (54%) in the next 5 years.

Businesses want to hire, but high costs are making it harder.

Small businesses report better business conditions now than in 2022 and are responding by trying to hire new workers. Most (61%) report they have one or more open positions they are looking to fill, particularly larger businesses. But hiring as a Massachusetts-based small business has not been easy, and a majority report that filling those positions is at least somewhat difficult. The top two obstacles to hiring are familiar: the high cost of living and the high cost of housing. Those high costs are putting pressure on wages. The third most common challenge to hiring is applicants seeking higher pay than what is being offered.

Concerns about the cost of living, and of housing in particular, have been top of mind for the state’s residents for the past several years, according to many other polls conducted by MPG and others. This survey shows that they are having an effect on small businesses, as well.

Demand for – and access to – capital varies widely

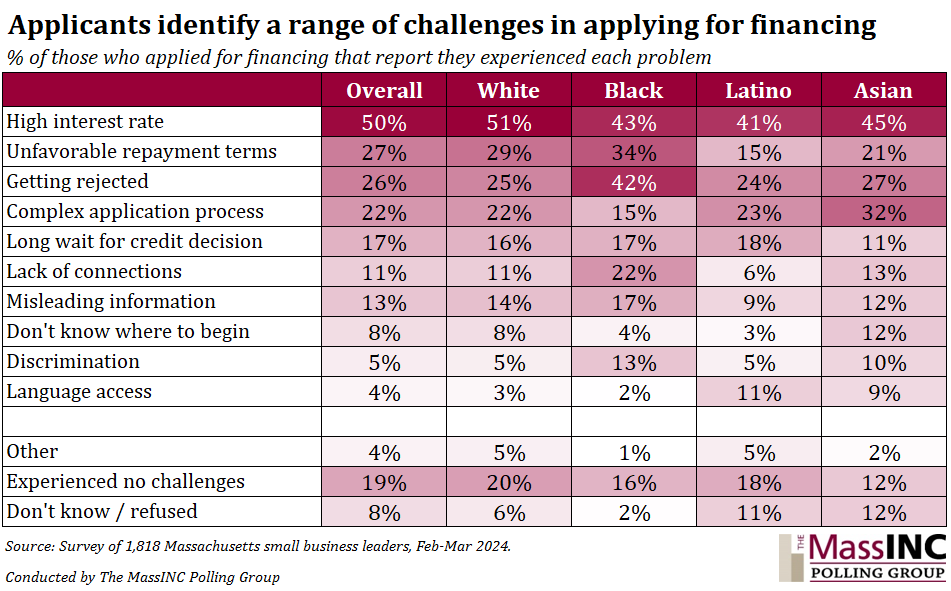

Access to capital is an especially high priority for Black and Latino-owned businesses, who hope to use the funding to buy equipment, hire, expand, and simply to help cover operating costs. But the survey reveals a troubling gap in financing: 47% of white-owned businesses report receiving all the capital they applied for, compared to about a third or less of Asian (35%), Latino (34%) and Black-owned businesses (31%). Technical assistance provided by non-profits, community, organization, and state agencies can help with a range of business challenges, but most remain unfamiliar with the offerings.

Applying for loans has also gotten harder since the 2022 wave of the survey, led by much higher interest rates. Black-owned businesses report being rejected at a far higher rate than other businesses. Demand for technical assistance to help secure funding is also up from the 2020 and 2022 waves of the survey, with 74% of businesses saying that help applying for grants would be very useful, along with help finding new revenue sources (61%) and low interest loans (50%).

Small business and climate change

About two-thirds (65%) of small businesses think that climate change could have a negative impact on their bottom lines, with power outages (44%) and higher insurance rates (40%) the most common concerns. While 65% of small businesses think that increasing their use of clean energy is at least “somewhat important,” just 40% say they have at least “some control” over where their power comes from. Still, 63% of businesses have taken at least one step towards sustainability, with reducing waste (44%) being the most common action. White-owned businesses are most likely to have taken action, but this may be more of a function of their tending to be larger and older. Majorities of Black and Latino-owned businesses say that increasing their clean energy use is “very important”, but these businesses are less likely to have pursued clean energy or energy audits, suggesting a gap between desire and opportunity.

About the survey

These results are based on a survey of 1,818 small business leaders (with fewer than 500 employees) in Massachusetts. The survey fielded February 6, 2024 - March 21, 2024, during which small businesses were contacted by a network of sponsoring and participating organizations and invited to complete an online survey. The survey was offered in English, Spanish, Portuguese, Mandarin, Vietnamese, and Haitian Creole. The final survey data was weighted to estimate population parameters by race and gender of the business owners, based on data from the U.S. Census and the Small Business Administration. The survey was conducted by The MassINC Polling Group on behalf of the Coalition for an Equitable Economy, with sponsorship from the Mass Growth Capital Corporation and Eastern Bank Foundation. Community engagement support was provided by Harvard Catalyst.